marin county property tax exemptions

Ad Property Tax Appeal Get Results No Up-front Costs - Guaranteed Savings. If you enter your parcel number the website pulls up a list of all the exemptions for which you are eligible that show up on your tax bill.

For Seniors Keeping Your Property Taxes Low

Additionally parcels which are classified by County Assessor Use Codes 15 and 53 90 are also exempt from this tax.

. If you enter your parcel number the website pulls up a list of all the exemptions for which you are eligible that show up on your tax bill. By applying for the Homeowners exemption you can save approximately 70 on your property taxes each year. Learn About Your Senior Exemptions The county provides a list of exemptions for property tax items that apply tour property.

Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you. An election will be held within the boundaries of San Rafael City Elementary School District Elementary School District on June 7 2022 to authorize the sale of up to. A citys property tax provisions must comply with California statutory rules and regulations.

Senior Exemptions To apply for Senior Exemptions please complete and return the Senior Exemption Application form. The Marin County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. The California Constitution provides for the exemption of 7000 maximum in assessed value from the property tax assessment of any property owned and occupied as the owners principal place of residence.

Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. To maintain rapid 9-1-1 emergency response times and preserve the number of on-duty paramedics ready to respond to accidents medical emergencies shall the Ross Valley Paramedic Authority measure be adopted continuing for four years the paramedic services special tax of 9450 per residential living unit or 1500.

This should look like 099-999-99. Look on your tax bill for your Parcel Number or APN. In addition taxpayers eligible for a property tax exemption such as the homeowners exemption will be taxed at a lower effective tax rate than described above.

REGARDING PROPOSED 152000000 SAN RAFAEL CITY ELEMENTARY SCHOOL DISTRICT GENERAL OBLIGATION BONDS. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you. Voters should note the estimated tax rate is based on the assessed value not market value of taxable property on the Marin Countys official tax rolls.

MARIN COUNTY PROPERTY OWNERS From. There is also a full list of such exemptions countywide. Owners rights to timely notification of rate raises are also mandated.

The individual districts administer and grant these exemptions. Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. MEASURE JTOWN OF SAN ANSELMO.

The city determines tax levies all within California regulatory guidelines. Certain agencies eg sewer and water send a bill to the property owner or renter directly and offer discounts some of which we describe further down this page. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70. Parcel Tax Exemptions Marin County Free Library Parcel Tax Exemptions Applications for Senior and Contiguous Exemptions for FY 2021-22 are now available. Marin Countys 91184 tax bills were mailed on Friday.

The District shall annually provide to the Marin. ARROW Auditor-Controller County of Marin TAX RATE AREAS This booklet which includes all. The 2020-2021 tax roll amounted to 122 billion up 573 over the previous year.

Ad One Simple Search Gets You a Comprehensive Marin County Property Report. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. There is also a full list of such exemptions countywide.

Owner must be 65 years old or older by July 1 of any applicable tax year Property must be an owner-occupied single-family residence house condo townhome An exemption application must be filed annually before June 30th. TAX RATE STATEMENT FOR BOND MEASURE C. The individual districts administer and grant these exemptions.

Find Marin County Online Property Taxes Info From 2021. Parcels which are classified by County Assessor Use Codes 12 Mobile home and 13 House Boat are exempt from this parcel tax. All property not exempted should be taxed evenly and uniformly on a single current market worth basis.

2022 will receive a 50 parcel tax exemption for the 2022-2023 tax year and full parcel tax exemption effective July 1 2023 for the 2023-2024 tax year. Applications must be filed on or before June 1 2022. Normally the property tax bills are payable in two.

Non- Profit Charitable 501 c 3 Exemption. Shelly Scott Assessor - Recorder - County Clerk Homeowners Exemption All homeowners in Marin County may be eligible for a 7000 exemption on the assessed value of their primary home. Any unit of real property in the District that receives a separate tax bill for ad valorem property taxes from the County Tax.

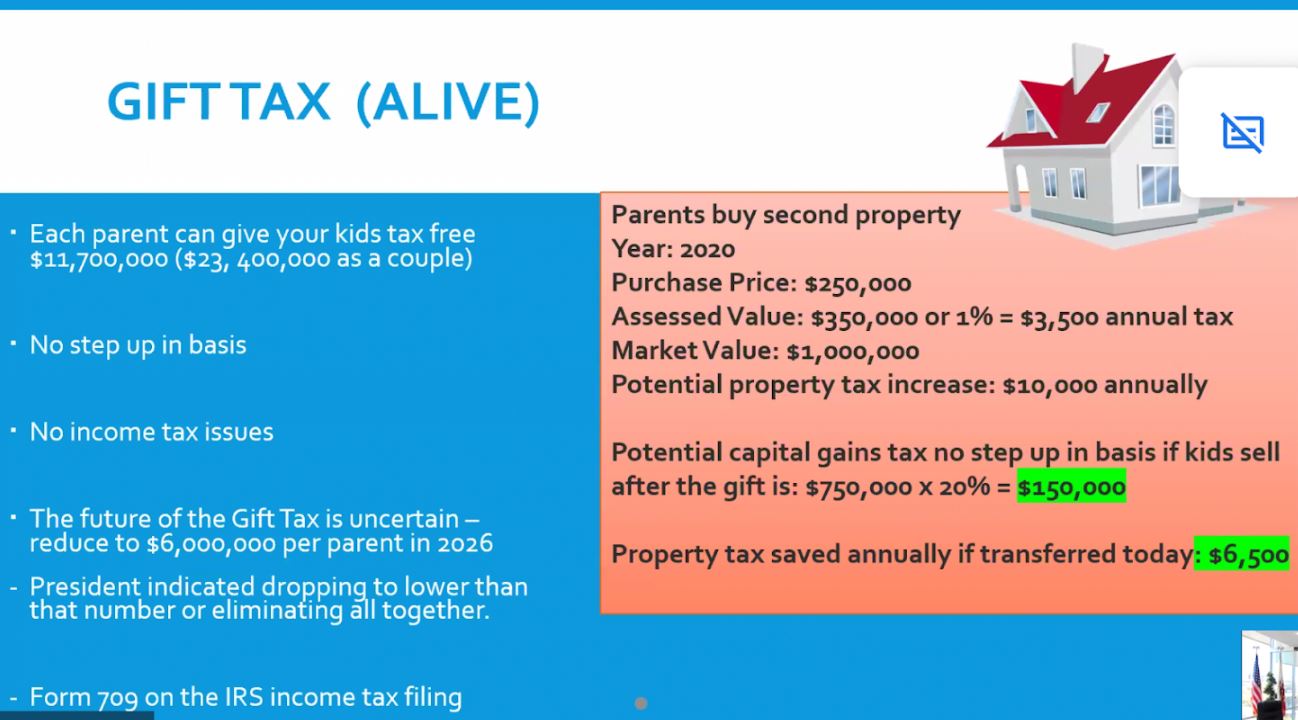

Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house.

What Is A Homestead Exemption California Property Taxes

Sc Johnson S Administration Building Research Tower Exempt From Property Taxes Frank Lloyd Wright Homes Frank Lloyd Wright Architecture Building

Property Tax Re Assessment Bubbleinfo Com

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

Property Tax Bills On Their Way

Property Tax Exemption For Live Aboards

Property Tax Re Assessment Bubbleinfo Com

For Seniors Keeping Your Property Taxes Low

Marin Residents Have Until Monday To Pay Property Taxes

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5FHWRWLNJRAPVLHXCMLUYRY5IM.JPG)

How To Slug It Out With Your Governing Bodies Over Property Taxes

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing